Our Approach

Sustainable Trading is a non-profit membership network supporting the global markets trading industry as it seeks to improve Environmental, Social and Governance (E, S and G) business practices.

It achieves this through multiple workstreams in which member firms contribute to the development of E, S and G best practices around operational processes and workflows associated with trading. These are accompanied by a standardised measurement framework, supporting members to:

- Implement practical improvements in trading businesses

- Demonstrate progress towards enterprise-wide ESG goals

- Contribute to industry-wide ESG improvement

Sustainable Trading members represent global markets firms including buy and sell side businesses, exchanges and trading platforms, specialist technology and service providers.

Membership is open to all global markets participants engaged in trading or providing trading-related services.

The Path to Sustainable Trading

Sustainable Trading was launched against a backdrop of the wider ESG shift in the global markets, and the need to transition to a more sustainable future. Beyond regulatory obligations, the pace of change is driven by the demands of shareholders, customers, employees and other key stakeholders.

Key Objectives

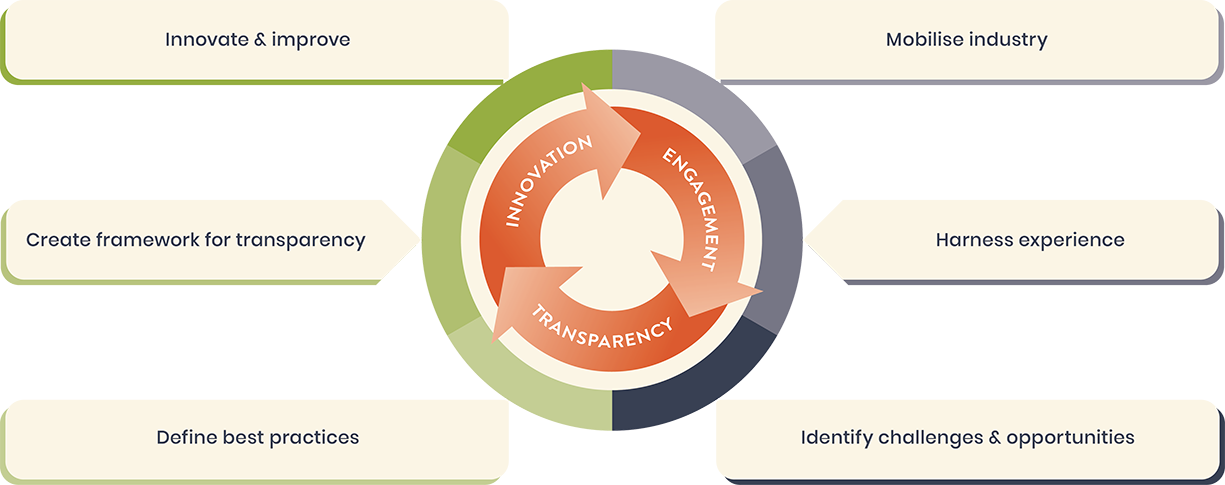

Driving E, S and G Best Practices

- Establish and host specialist work streams to define best practices and challenge existing approaches

- Formulate E, S and G best practices for member organisations

- Provide a measurement framework to communicate progress consistently

- Foster a mindset of continuous improvement

We provide a collaborative space for our members to explore mutual issues and concerns, collaborate on addressing specific sustainability challenges and establish the tools required to champion E, S and G best practices, internally and externally.

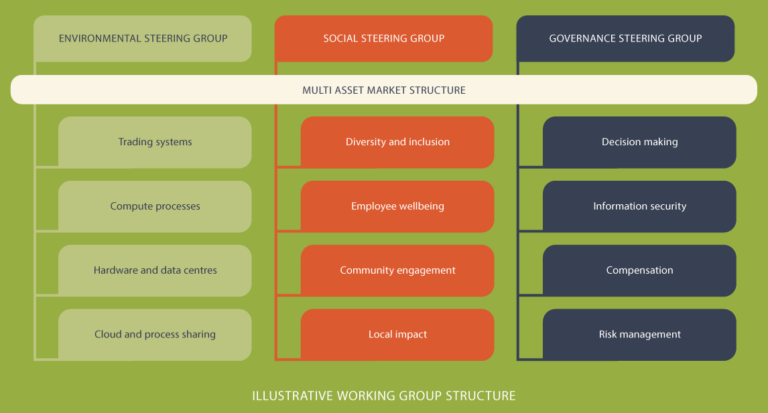

We facilitate working groups that explore, develop and refine sets of best practices. These groups are made up of industry experts who share expertise and experience to support research on sustainability standards and gaps in the trading industry. We work with the wider industry to drive and implement change.

We encourage and support firms to adopt Sustainable Trading best practices and utilise a standardised framework for measuring outcomes. This enables the trading industry to hold itself to account on delivery.

Our approach

A collective commitment to industry adoption

practices add to this consumption through everyday behaviours, such as business travel and event material use.

For climate targets to be met, substantial improvements in energy efficiency are required in order to decrease

the energy intensity of the global economy by two-thirds, with the EU setting a 40% reduction target for 2030.

Our specialist workstreams focus on the industry’s complex systems and high-intensity technology

as well as day-to-day business practices which both have an impact on energy and resource use.

diversity while, according to the Boston Consulting Group, diverse teams lead to greater and improved innovation

and performance. Reduced diversity may also be associated with greater social exclusion within the wider population.

Our platform will increase understanding of the importance of diversity and inclusion and create a structure

that encourages business units to improve through talent, culture and community, prioritising community

engagement to strengthen the connection trading has with communities of diverse backgrounds.

which impress a range of governance requirements on the businesses operating within it. With differing levels

of complexity and applications of regulation, there is an opportunity to improve governance across the industry.

Our workstreams are exploring how improved communication within or between firms on subjects including

execution policies, recording of communications, ethical standards, and personal account dealing procedures

will enhance the knowledge of trading employees and thereby strengthen firms.

An industry-led, consensus-driven approach will accelerate the pace of systemic change and embed consistent governance – and sustainable business practices – across the financial trading industry.

Sustainable Trading’s cross-industry working groups will consider issues, challenges and opportunities and determine ESG best practices to support firms’ plans.

Specifically, working groups will:

- Assess the environmental impact of building, operating and maintaining financial trading infrastructures, identifying new approaches for power optimisation and energy efficiency.

- Share insights and experiences to increase understanding of the importance and impact of diversity, equity and inclusion with the aim of influencing positive change across the industry.

- Look at broader ESG challenges including employee wellbeing, engagement with communities and stakeholder-oriented enterprise governance.

Driving ESG best practice in trading

“Diversity and inclusion contribute directly to the stability, fairness and effectiveness of the financial sector. There is therefore a strong shared interest in moving towards a more diverse and inclusive industry.”

“Modifying existing practices to better address environmental and social sustainability matters is simply good business: it can help win customers; attract and retain talent; reduce costs and increase efficiency; and minimize risk and potential reputational damage. “

Setting the standard for ESG best practice

ESG best practices, developed by the industry for the industry, can be used as a roadmap for change for firms operating across a wide range of trading activities. Best practices will recognise the great work already underway in many firms and provide opportunities for all firms to improve their ESG impact.

Benchmarking tools

Sustainable Trading will oversee a benchmarking framework enabling self-certification and transparency, facilitating an ethos of continuous improvement for ESG best practices.

Benchmarking tools that collect tailored metrics and enable certification against industry best practices will support greater engagement and transparency between providers and clients.

Frequently Asked Questions

Provider firms will be able to use a transparency framework to benchmark themselves against the list of ESG best practices for a certain trading service. Through this benchmarking approach they will be able to measure their progress for each of E, S, and G along with an overall sustainability result. By implementing more of the best practices, they will be able to improve the sustainability of their offering and demonstrate an improvement in ESG.

Best practice benchmarking will also allow firms to compare their own sustainability and ESG position against the rest of the market. More detailed market comparison and analysis services may also be offered to members.

As benchmarking is against standardised best practices, providers will be able to efficiently communicate with clients and demonstrate their commitment to increasing sustainability in the trading industry. With sustainability an increasingly important topic for clients, being able to demonstrate the contribution of a provider to sustainable trading will be increasingly important.